In the complex world of finance, insolvency is a term that often arises in discussions surrounding financial distress. This article aims to unravel the legal dimensions of insolvency, from its definition to its implications and the legal framework surrounding it. By understanding the intricacies of insolvency, individuals and businesses can navigate the legal landscape when faced with financial difficulties.

Defining Insolvency: A Legal Perspective

Insolvency and restructuring, in legal terms, refers to a situation where an individual or an entity is unable to meet their financial obligations by the due dates. It entails a state of financial distress where the assets of the debtor fall short of their liabilities.

While insolvency may appear to be a straightforward concept, various legal implications arise from such a circumstance. Understanding these legal dimensions is crucial to grasping the full picture of insolvency.

The Concept of Insolvency

Insolvency is rooted in the notion that an individual or business can no longer fulfill their financial commitments. It signifies a pivotal moment when the financial health of a debtor deteriorates to an extent where they are unable to honor their obligations.

Insolvency can take several forms, including cash flow insolvency, balance sheet insolvency, or technical insolvency. Each type presents unique challenges, and the legal perspective on them may differ.

Cash flow insolvency occurs when a debtor has insufficient liquid assets to meet their immediate financial obligations. This means that even though they may have valuable assets, such as property or investments, they lack the necessary cash flow to pay their debts as they become due. In such cases, the legal implications may involve exploring options for generating additional cash or negotiating payment plans with creditors.

Balance sheet insolvency, on the other hand, arises when a debtor’s liabilities exceed their assets. This indicates a situation where the debtor’s overall financial position is negative, and they may struggle to repay their debts in full. From a legal standpoint, balance sheet insolvency may lead to the consideration of debt restructuring or bankruptcy proceedings to address the financial imbalance.

Technical insolvency refers to a scenario where a debtor is unable to meet their financial obligations due to legal or technical constraints, even if their financial position appears healthy. For example, a business may have significant assets, but if those assets are tied up in legal disputes or cannot be easily converted into cash, the debtor may still be considered technically insolvent. In such cases, the legal implications may involve resolving the legal obstacles or finding alternative ways to meet the financial obligations.

See Also: A Guide to Insolvency Legal Strategies

Legal Implications of Insolvency

When an individual or business becomes insolvent, numerous legal implications come into play. Creditors, who are owed money, have specific rights and remedies to ensure they receive at least a portion of what they are owed. These legal ramifications aim to strike a balance between the interests of the debtor and the creditor.

One common legal implication of insolvency is the initiation of bankruptcy proceedings. Bankruptcy provides a structured legal framework for the orderly distribution of assets among creditors and the discharge of the debtor’s remaining debts. The bankruptcy process involves the appointment of a trustee who manages the debtor’s assets, investigates their financial affairs, and distributes the available funds to creditors according to a predetermined hierarchy.

Another legal implication is debt restructuring. In cases where the debtor’s financial distress is temporary or can be resolved through a reorganization of their debts, debt restructuring offers an alternative to bankruptcy. Debt restructuring involves renegotiating the terms of the debts, such as extending the repayment period, reducing interest rates, or even forgiving a portion of the debt. This legal process aims to provide the debtor with a realistic opportunity to regain financial stability while ensuring that creditors receive a reasonable return on their investments.

In some instances, insolvency may trigger court-supervised insolvency processes. These processes involve the appointment of a court-appointed administrator or receiver who takes control of the debtor’s assets and manages their affairs in the best interests of all stakeholders. The administrator or receiver may oversee the sale of assets, negotiate with creditors, and develop a plan for the debtor’s financial recovery.

It is important to note that the legal implications of insolvency can vary depending on the jurisdiction and the specific circumstances of each case. Therefore, seeking professional legal advice is crucial for individuals or businesses facing insolvency to navigate the complex legal landscape and make informed decisions.

The Legal Framework of Insolvency

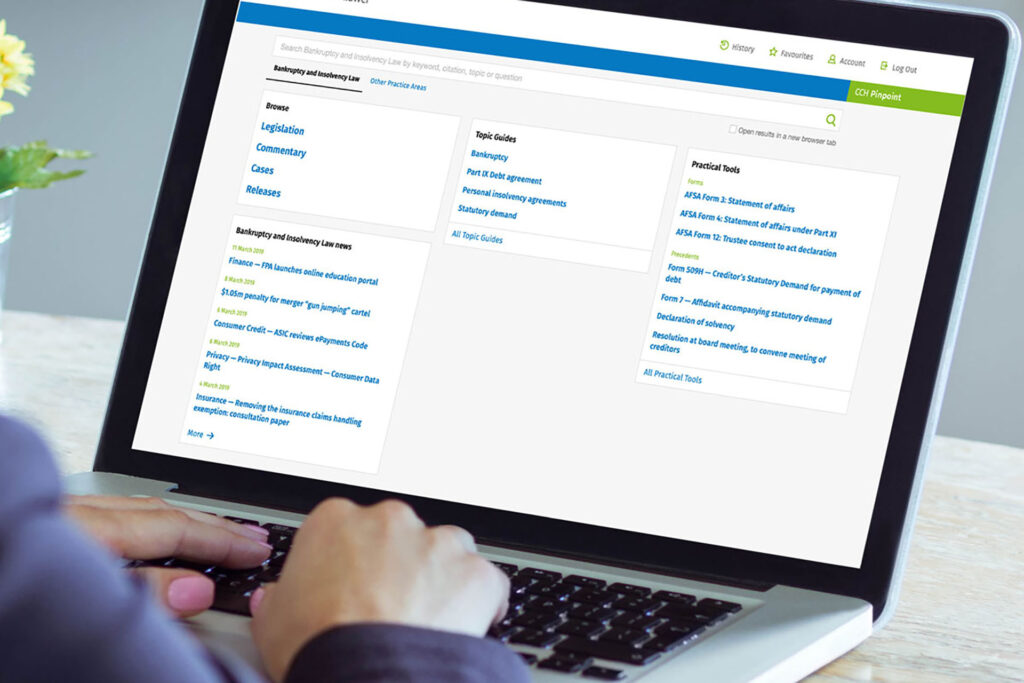

In order to handle cases of insolvency effectively, a robust legal framework is necessary. This framework consists of bankruptcy laws and regulations, as well as the role of insolvency practitioners who play a crucial part in the process.

Insolvency is a complex and challenging situation that can have far-reaching consequences for individuals and businesses. Without a well-defined legal framework, the resolution of insolvency cases would be chaotic and unfair. Bankruptcy laws and regulations provide the necessary structure and guidelines to ensure a systematic and equitable approach to dealing with financial distress.

Bankruptcy Laws and Regulations

Bankruptcy laws and regulations outline the procedures and rules to manage insolvency cases. These laws, which may vary from jurisdiction to jurisdiction, provide a structured approach to address the financial distress faced by individuals and businesses.

One of the key aspects of bankruptcy laws is debt discharge. This provision allows individuals or businesses to have their debts forgiven or partially discharged, providing them with a fresh start. However, debt discharge is not a blanket solution and is subject to certain conditions and limitations.

Asset liquidation is another critical component of bankruptcy laws. When a business or individual is unable to meet their financial obligations, their assets may be sold to repay creditors. This process is carefully regulated to ensure that the assets are sold at fair market value and that the proceeds are distributed equitably among the creditors.

Furthermore, bankruptcy laws often include provisions for proceedings to ensure the fair distribution of assets among creditors. These proceedings aim to prevent preferential treatment of certain creditors and ensure that all creditors receive a fair share of the available assets.

Overall, the primary objective of bankruptcy laws and regulations is to provide a legal framework that ensures fair treatment and an equitable resolution for all parties involved. By establishing clear rules and procedures, these laws help maintain the integrity of the insolvency process and protect the rights of both debtors and creditors.

The Role of Insolvency Practitioners

Insolvency practitioners, also known as bankruptcy trustees or receivers, play a pivotal role in insolvency proceedings. These professionals are licensed and regulated individuals with expertise in managing financially distressed situations.

Their role involves assessing the assets and liabilities of the insolvent entity or individual, exploring avenues for debt restructuring or asset liquidation, and ensuring a fair distribution of assets among creditors. Insolvency practitioners act as neutral facilitators, guided by legal and ethical principles, to achieve the best possible outcome for all parties involved.

Insolvency practitioners are appointed by the court or chosen by the creditors to oversee the insolvency process. They have a fiduciary duty to act in the best interests of all stakeholders, including debtors, creditors, and shareholders. This duty requires them to exercise due diligence, transparency, and impartiality throughout the proceedings.

One of the key responsibilities of insolvency practitioners is to assess the financial situation of the insolvent entity or individual. This involves conducting a thorough review of the assets, liabilities, and financial records to determine the extent of the insolvency and the available options for resolution.

Based on their assessment, insolvency practitioners may recommend debt restructuring as a viable solution. Debt restructuring involves renegotiating the terms of the debts to make them more manageable for the debtor while ensuring a reasonable return for the creditors. This process requires careful negotiation and analysis to strike a balance between the interests of all parties involved.

If debt restructuring is not feasible or does not provide a sustainable solution, insolvency practitioners may recommend asset liquidation. Asset liquidation involves selling the assets of the insolvent entity or individual to generate funds for repayment to creditors. Insolvency practitioners oversee this process to ensure that the assets are sold at fair market value and that the proceeds are distributed equitably among the creditors.

In conclusion, the legal framework of insolvency encompasses bankruptcy laws and regulations, as well as the role of insolvency practitioners. These elements work together to provide a structured and equitable approach to resolving cases of financial distress. By establishing clear rules and guidelines, the legal framework ensures fairness and protects the rights of all parties involved in the insolvency process.

The Process of Declaring Insolvency

Declaring insolvency is a significant step in acknowledging financial distress and seeking a resolution. The process involves several steps that need to be followed meticulously to ensure compliance with the legal requirements.

Steps Towards Declaring Insolvency

When an individual or business reaches the point of insolvency, the first step is to consult with legal professionals specializing in insolvency law. They can guide the debtor through the process of declaring insolvency, ensuring compliance with all legal obligations.

The subsequent steps may involve gathering financial documentation, preparation of a statement of affairs, and filing the necessary documents with the relevant insolvency authorities. The involvement of legal professionals experienced in insolvency matters is crucial to navigate these steps smoothly.

Legal Consequences of Declaring Insolvency

Once insolvency is declared, there are legal consequences that come into effect. Creditors may be notified, and their claims will be assessed in accordance with the legal framework in place.

Furthermore, the declaration of insolvency may trigger automatic stays on legal actions initiated by creditors, allowing for a controlled and organized approach to address the financial distress. These legal consequences serve to create a structured pathway for individuals and businesses to resolve their financial difficulties.

Debt Restructuring and Insolvency

Debt restructuring is an alternative to bankruptcy, allowing individuals and businesses to reorganize their finances and develop a feasible repayment plan. Understanding the legal provisions surrounding debt restructuring is essential when dealing with insolvency.

Legal Provisions for Debt Restructuring

Debt restructuring requires a legal framework that allows for negotiations between debtors and creditors to reach an agreement on debt repayment terms. Such legal provisions provide a platform for parties involved to explore viable alternatives to bankruptcy.

The legal framework typically provides guidelines for negotiations, debt repayment plans, and mechanisms to monitor and enforce the terms of the restructuring agreement.

Impact of Debt Restructuring on Insolvency

Debt restructuring can have a profound impact on the outcome of an insolvency situation. By providing an opportunity for debtors to repay their debts in a controlled manner, it offers an alternative to liquidating assets and facing potential bankruptcy.

The legal framework for debt restructuring aims to strike a balance between the interests of the debtor and the creditors while ensuring a viable path toward financial stability and debt repayment.

The Role of Courts in Insolvency Proceedings

Courts play a crucial role in insolvency proceedings, providing oversight and guidance to ensure fair and equitable resolutions to financial distress cases.

Judicial Oversight in Insolvency

Judicial oversight ensures that insolvency proceedings adhere to legal requirements and principles. Courts oversee the process, verifying compliance with applicable laws and regulations, and evaluating the fairness of proposed resolutions.

By providing an impartial forum for disputes, courts safeguard the rights of all parties involved, allowing for transparent and just outcomes in insolvency cases.

Court Decisions and Their Impact on Insolvency

Decisions made by courts in insolvency cases can set legal precedents and shape the future interpretation and application of insolvency laws. These decisions have far-reaching consequences and can influence the legal landscape of insolvency proceedings for years to come.

By examining past court decisions, individuals and businesses can gain valuable insights into the evolving legal principles and precedents related to insolvency.In conclusion, understanding the legal dimensions of insolvency is essential when faced with financial distress. By comprehending the concept of insolvency, the legal implications it entails, and the framework surrounding it, individuals and businesses can navigate the complex world of insolvency with clarity and confidence. Whether it be through bankruptcy proceedings, debt restructuring, or court oversight, the legal landscape offers various avenues to address financial distress and seek a resolution that balances the interests of all parties involved.