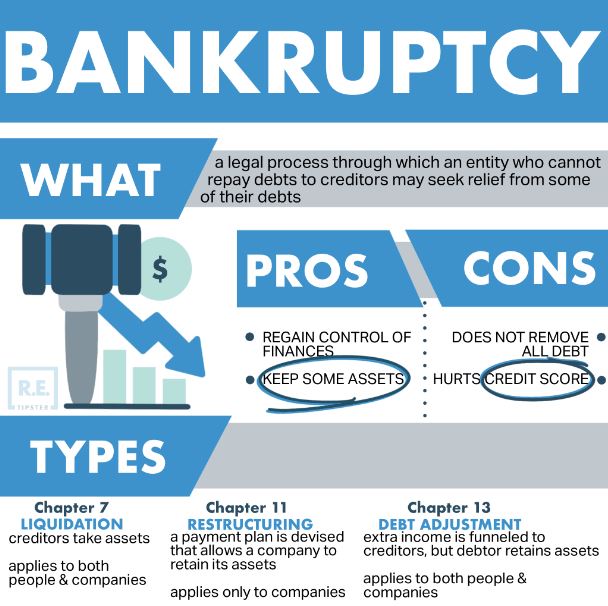

Estate planning in Canberra is more relevant than ever. With the growth in trusts and estates legal services, securing your financial future and protecting your personal assets is now essential. In a market set to nearly double in value by 2030, estate planning lawyers play a vital role not only in drafting wills and organising estates but also in navigating digital assets and modern privacy concerns. This comprehensive guide reveals how professionals based in Canberra help individuals and families safeguard their assets over the long term. With a rapidly evolving legal landscape, the expertise of estate planning lawyers canberra is guiding families through intricate processes, ensuring that assets, both physical and digital, are protected for future generations. Their role is central in establishing robust strategies that align with newly emerging legal precedents and technological innovations. The Rising Importance of Estate Planning in Today’s Market Understanding Market Trends and Growth Recent studies indicate impressive growth in the trusts and estates legal services market. With projections suggesting an increase from $25.1 billion in 2024 to $49.8 billion by 2030, the compound annual growth rate of 9.2% is hard to ignore. Such figures demonstrate the increased reliance on estate planning as a means to protect wealth in a tumultuous economic environment. Beyond the numbers, market trends reveal the growing complexity of contemporary financial portfolios. Families today need comprehensive planning that goes beyond crafting a simple will. Estate planning lawyers in Canberra are well-equipped to address these challenges, ensuring that every asset is accounted...